Homeowners Insurance in and around Cedar Park

Homeowners of Cedar Park, State Farm has you covered

Help cover your home

Would you like to create a personalized homeowners quote?

- Austin

- Cedar Park

- Leander

- Liberty Hill

Home Is Where Your Heart Is

Everyone knows having excellent home insurance is essential in case of a tornado, blizzard or hailstorm. But homeowners insurance is about more than covering natural disaster damage. One important part of home insurance is its ability to protect you in certain legal situations. If someone has an accident at your residence, you could be held responsible for their hospital bills or their lost wages. With the right home coverage, these costs may be covered.

Homeowners of Cedar Park, State Farm has you covered

Help cover your home

Protect Your Home Sweet Home

With this outstanding coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Shannon Johnson would love to help you get the policy information you need, just visit them to get started.

For excellent protection for your home and your keepsakes, check out the coverage options with State Farm. And if you're ready to get a quote on a home insurance policy, stop by State Farm agent Shannon Johnson's office today.

Have More Questions About Homeowners Insurance?

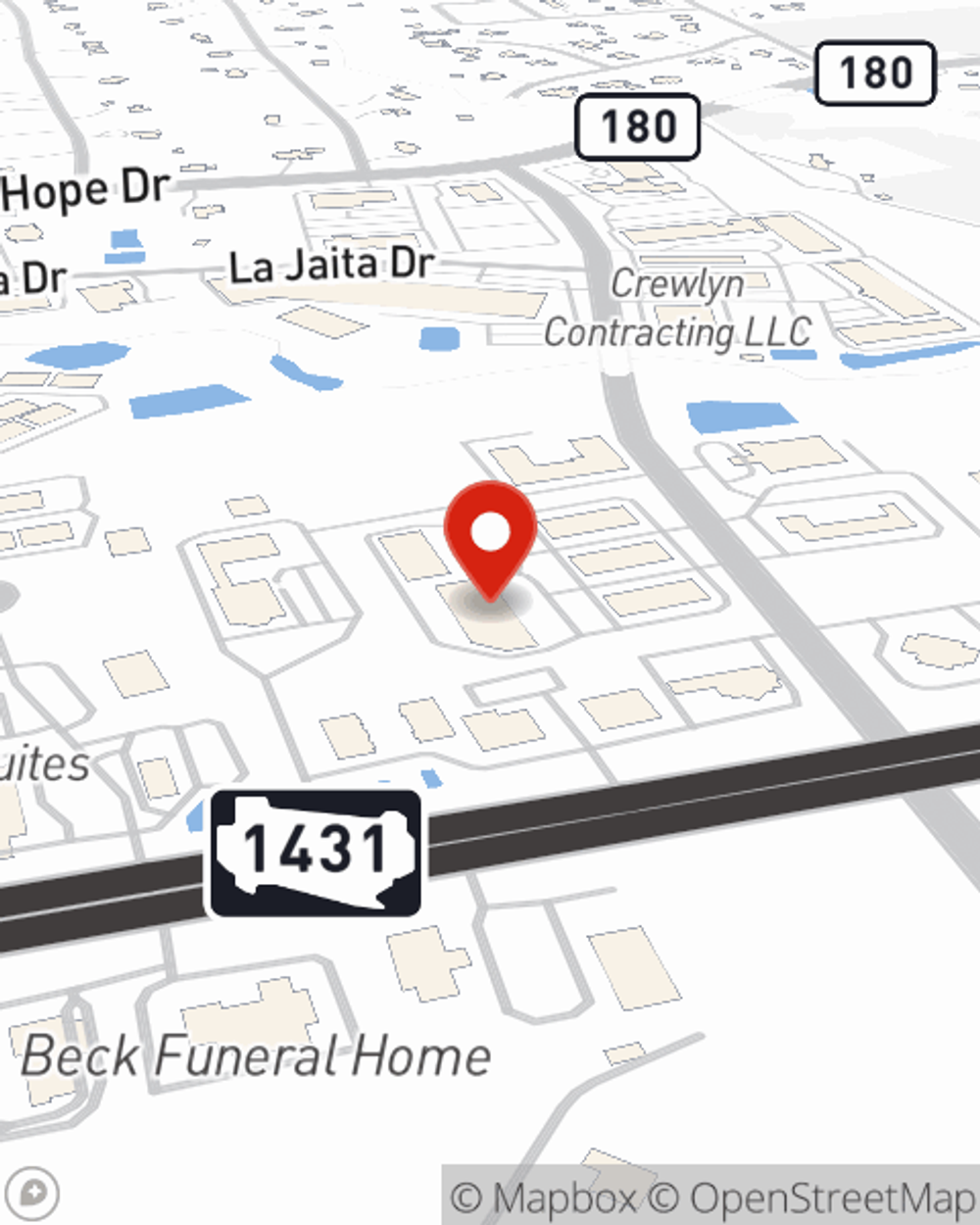

Call Shannon at (512) 258-5834 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Ways to stay safe during a severe storm or wind event

Ways to stay safe during a severe storm or wind event

Severe weather and wind are common throughout the country. Read these severe weather safety tips to help with your emergency planning.

Shannon Johnson

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Ways to stay safe during a severe storm or wind event

Ways to stay safe during a severe storm or wind event

Severe weather and wind are common throughout the country. Read these severe weather safety tips to help with your emergency planning.